The company promises a dividend every year but if it fails to make a profit and has to close down preference shareholders receive higher compensation. Shareholders are the owners of the business and share the success or failure of the business.

A ordinary shares and B ordinary shares or different types of shares eg.

. Preference Shares have a priority claim over the companys assets and earnings. A company may issue. CA2016 stipulates inter alia that a company that allots any preference shares or converts any issued shares into preference shares shall set out.

Unlike ordinary shares preference shares give the investors greater upside potential and a level of downside protection in return for their investments. In a Malaysian company there are two types of shares. Step by step guide to issuance of preference shares including determination of the rights Differentiating the classification of preference shares as equity or liability.

Introduction 11 The Securities Commission of Malaysia enhanced the Guidelines on Unlisted Capital Market Products under the Lodge and Launch Framework issued on 9 March 2015 and revised on 28 April 2020 LOLA Guidelines with effect from 28 April 2020. Skrine is one of the largest law firms in Malaysia providing a comprehensive range of legal services to a large cross-section of the business community in Malaysia as well as abroad. On resolution which varied the rights attached to preference shares.

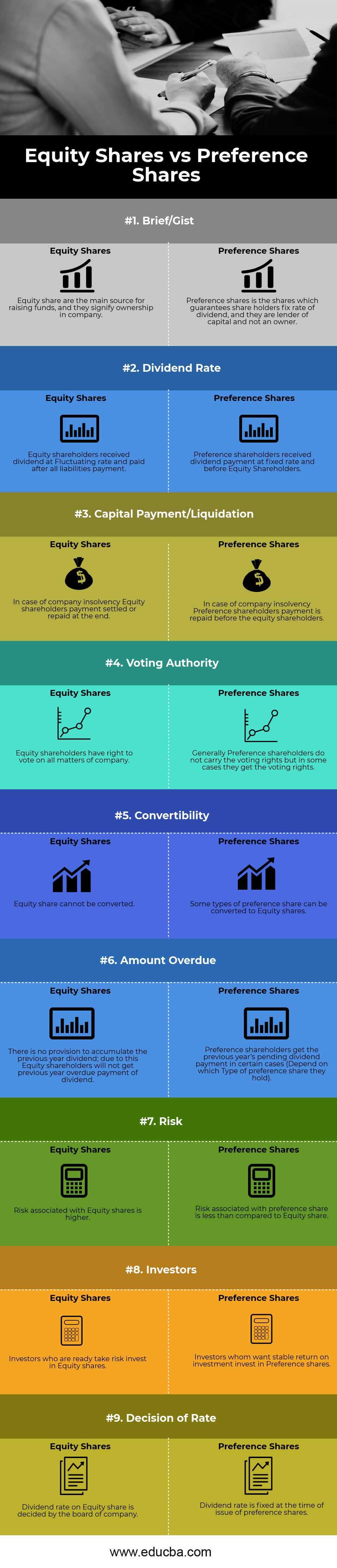

Strategic consideration for issuance of preference shares advantages and disadvantages. To determine the accounting treatment of preference shares and dividend on such shares first you have to identify if preference shares are redeemable or irredeemable. Under the CA preference shares are redeemable out of profits a fresh issue of shares or capital of the company.

If the companys valuation and equity continue to rise this may be a beneficial choice. RM400 million Preference Shares Terms and conditions 6 2 pari passu with all Parity Obligations. By analogy the investor is giving a loan to the company and the company issue preference shares to the investor giving him.

It also aims to study Sharīʿah issues arising from preference shares and to subsequently propose solutions for identified issues that will help in structuring Islamic preference shares. To prioritize distribution of dividends and. And 3 senior to the holders of OCBC Malaysias ordinary shares and any other securities or obligations of OCBC Malaysia that are subordinated to the Preference Shares.

Abstract Purpose The purpose of this paper is to analyze the different features of preference shares from accounting and Sharīʿah perspectives. The Companies Amendment Act 2019 the Act has introduced a new redemption method for preference shares ie. The performance of the business can often be measured by the amount of dividends shareholders receive and by the price of the share quoted on the stock market.

Low paid up capital share premium. Preference shares represent an ownership stake in a company and sometimes it called preferred stock. Section 55 of the Companies Act 2013 read with Rule 9 of the Companies Act Share Debt and Capital 2014 allows the Company to issue preference redeemable shares.

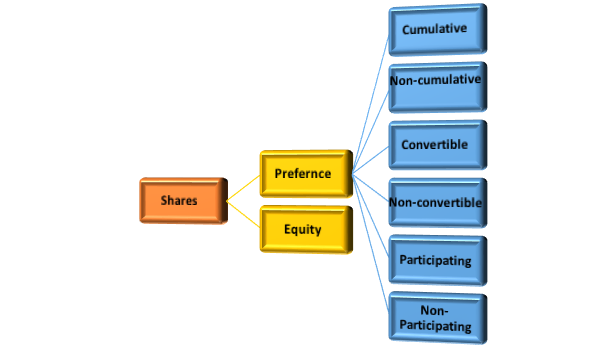

Preference shareholders have the option of exchanging their shares for a set number of ordinary shares. Holders of preference share are entitled to receive company assets before ordinary shareholders when the company is insolvent. Types of preference shares cumulative redeemable participative and convertible.

Designmethodologyapproach The paper uses a. First and foremost it is important to note that preference shares function like a debt instrument eg. Incorporate with RM2 issued and paid up shares at RM1 par value per share and the company issuessells shares at a premium ie above the shares par value.

They are generally regarded as equity investments. But callable preference shares may be retired by the issuing company upon the payment of a definite price stated in the. Accounting treatment for redeemable preference shares If preference shares are redeemable then shares are reported as liability in statement of financial position.

As per section 55 of the Act a company can issue only redeemable preference shares ie a company is not allowed to issue irredeemable preference shares. Tenure for Preference Shares. Pursuant to section 725 where preference shares are redeemed out of profits or capital of the company the company would be required to transfer out of profits an equivalent amount into the share capital of the company.

A share is a security which represents a portion of the owners capital in a business. Loan rather than equity or in another word ownership. Normally preference shares have no maturity date.

Most preference shares have a par value. Under section 148 2 of the repealed Companies Act 1965 preference shareholders may vote. Redemption out of capital of the company which enables a company to.

The phrase high risk high reward does apply if the company does well. Ordinary shares possess more risk because dividends are dependent on the outcome s. Ordinary shareholders are also the last to get paid while preference shareholders are the first to be paid.

Under such initiative business entities are now permitted to issue conventional convertible notes to. This article provides an insight into the issue redemption of preference shares under the Companies. However the FAQ on the website of the Companies Commission of Malaysia states that.

On such a dissolution or winding up each Preference Share. Preference shares can have both equity and debt characteristics which favoured by investors who have different priorities and interests to safeguards. Preference shareholders are NOT the owner of the company.

Section 55 1 imposes a ban on the issuance of irredeemable preference shares. When it does the dividend rights and call price are usually stated in terms of the par value. Preference shareholders also receive dividends at a fixed and higher rate.

Preference shareholders however are fixed in dividends. Another option similar to this can be for the company to issue redeemable preference shares which has both debt and equity features. On this note it is mandatory for every company issuing preference shares to redeem them within a period of 20 years from the date of issue.

Most common type of shares issued. There is no equivalent provision under the CA 2016. Different rights can be attached to different classes and types of shares for various purposes such as.

By definition a preference share is a share by whatever name called which does not entitle the holder to a right to vote or to participate beyond a specific amount in distribution of dividend redemption or winding upPreference. Companies may issue different classes of the same type of shares eg. On resolution for winding up of the company.

Ordinary shares or preference shares. This is an interesting fact that although they.

Equity Shares Vs Preference Shares Top 9 Differences To Learn

Issue Redemption Of Preference Shares Companies Act 2013

Issue Redemption Of Preference Shares

/GettyImages-968680446-c87f6b0ea56748e2bdc73dfb4f96b688.jpg)

What Are The Different Types Of Preference Shares

130610 Date With Vol 1 2 Magazine With Yesung Interview Translation Yesung Super Junior Interview

Equity Shares Vs Preference Shares Top 9 Differences To Learn

Equity Shares Vs Preference Shares Top 9 Differences To Learn

Process For Issue Of Preference Shares Muds Management

Bariatric Surgery Market Size Forecast To 2022 Bariatric Surgery Bariatric Surgery

Procedure For Redemption Of Redeemable Preference Shares Lawrbit

Redeemable Preference Shares Examples Definition How It Works

Disney Quiz What Meg Are You Disney Quizzes Disney Quiz Quiz

Financial Accounting Analysis Financial Accounting Analysis Accounting

Health Benefits Of Fruit Jiuce Fruit Benefits Fruit Health Benefits Health Benefits